| The City of Hailey needs your help. The Local Option Tax (LOT) will sunset if our population goes above 10,000, as is expected in this year’s census. City leaders with the support of The Chamber would like to extend the “tourist-based tax” for 30 years. The following information explains the tax, what it’s used for and how to vote by May 16th to keep it going.

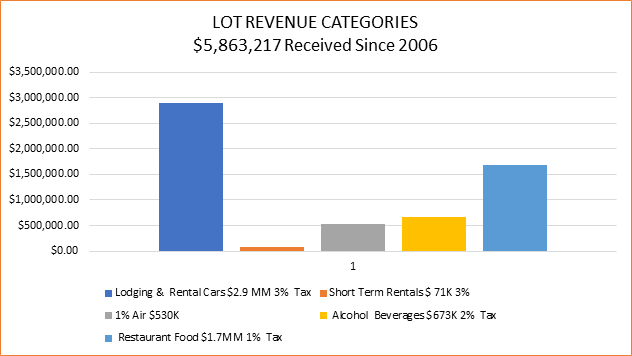

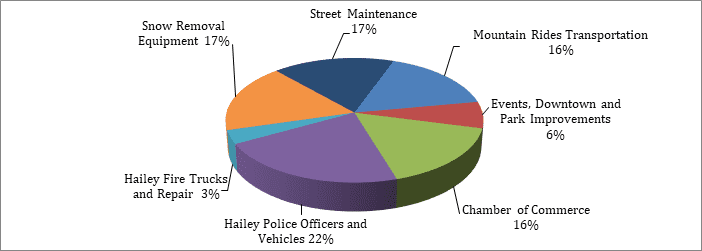

Thanks for your time and support! Voting methods have changed under Covid-19, but it remains important that all Hailey residents vote. The May election ballot contains an important Hailey ballot question about extending Hailey’s Local Option Tax. QUESTION: Shall the City of Hailey, Idaho adopt an extension to its local option tax with Hailey Ordinance No. 1257? Ordinance No. 1257 provides for the imposition, implementation and collection of non-property taxes for a period of thirty (30) years from its effective date, at the rate of three percent (3%) on the rental of passenger vehicles and hotel-motel room occupancy, two percent (2%) on retail sale of liquor by-the-drink, wine and beer, and one percent (1%) on the retail sale of restaurant food? The purposes for which the revenues derived from said taxes shall be used are: (A) Emergency services (rapid response, life saving, traffic enforcement, training, staffing, equipment, vehicles, etc.). Hailey’s Local Option Tax, when implemented in 2006, increased the city’s revenue by 10% and diversified the sources of revenue for city services. After 13 years, Hailey’s Local Option Tax has brought nearly $6 million to the City of Hailey.

How to Vote |

Bellevue Gateway to the WRV

Hailey Heart of the Valley

Ketchum Small Town, Big Life

Sun Valley The Genesis

Bellevue Gateway to the WRV

Ketchum Small Town, Big Life

Hailey Heart of the Valley

Sun Valley The Genesis